A Message from Retiring CEO Rick Redding

It has been an incredible honor to lead the Index Industry Association (IIA) over the last 12+ years and with a heavy heart that I announce my retirement as CEO. Knowing this milestone was approaching, I have found myself reflecting on the remarkable journey we’ve traveled since the IIA’s founding in 2012. According to ETFGI data, the global market for ETFs, mostly based on indexed-based products was approximately $1.95 trillion USD entering 2012 and ended 2024 at approximately $14.5 trillion USD. What began as a shared commitment to educate market participants, advocate for independent index providers and users worldwide, and promote industry standards and transparency has grown into an important voice in the global financial ecosystem. I am both proud of what the IIA has accomplished and excited about what lies ahead.

Born from the rapid growth of indexed-based investing, especially as ETFs came of age, the IIA was formed over a decade ago with a clear and vital mission: to educate investors on the attributes and role of indexes within the investment process, advance the interests of global index users and providers, and to push for industry standards of best practice, independence and transparency. Over the years, we’ve worked tirelessly to ensure that these principles remain core to everything we do.

Originally founded by three independent index providers – FTSE Russell, MSCI and S&P Dow Jones Indices – the IIA grew to represent the industry globally, now with 17 member firms headquartered across three continents.

Over my tenure, I’ve seen the complexity of markets evolve and the emergence of countless new asset classes lead to a broadening of investor appetite and advent of new indexes to meet these growing needs. It is our IIA members who have raised the bar for integrity and transparency in the index industry, enabling retail and institutional investors alike to save hundreds of billions across all segments of the investment landscape.

As the IIA strives to provide education on the benefits of indexes in the capital markets and to advocate on behalf of its members, some key accomplishments for the association that I am most proud of helping to spearhead these last 12 years include:

- Investor Education & Industry Transparency – We’ve worked with top industry experts across our member firms to produce content and thought leadership pieces in an effort to educate the marketplace on the role of the index provider and indexes within the broader global financial ecosystem. The IIA has provided transparency with its surveys, thought leadership, and research. The evidence is clear – indexes have provided direct and indirect savings of hundreds of billions, if not, over a trillion dollars over the past 12 years for the benefit of investors, not just those invested in indexed products. All investors benefit from indexes, especially from being a quick representation of the health of markets and to benchmarking returns of asset managers. There are over three million indexes globally administered by the IIA members and approximately 13,000 ETFs and ETNs. It is clear to see – more than 96% of indexes are not used for investment products, but for these other purposes. It would be impossible to think about markets today without indexes and investor education will continue to serve an even more important role given the increased size of the index industry.

- Regulatory Advocacy – The IIA represents independent index providers globally, advocating for fair and consistent regulation. Over the years we have worked closely with market participants, regulators, and other representative bodies to promote sound practices in the industry that strengthen markets and serve the needs of investors. The industry has been a disrupter for the benefit of investors worldwide and with that has faced push back from established, legacy stakeholders. Twelve years ago, the IIA was thrown into explaining the differences in independent, transparent indexes and price assessments, like LIBOR with their inherent conflicts of interests that lead to a worldwide crisis. While regulators and politicians have come a long way in understanding the benefits of indexes, there is still more work to do.

Since inception, the IIA has served as the unified voice for the index industry and remains committed to maintaining an open and constructive dialogue with a diverse group of market participants and stakeholders. It is through this engagement that meaningful advancements in the index industry can be accelerated, bringing greater transparency and strength to the global markets, which benefits all investors.

The future of the index industry is bright, but it will require us to remain adaptable, innovative, and committed to our core mission of investor education, advocacy, and transparency. The importance of these values has never been more evident, especially as global financial markets become increasingly complex and investor demand for index-based products grows. New advancements, regulatory oversight and technologies like AI are already at work reshaping the financial landscape, and the IIA will continue to be at the forefront of this transformation.

I want to extend my deepest thanks and gratitude to all of the IIA’s members, the Board, Advocacy, Marketing and Communications Committees and other key stakeholders who have helped us reach this point. The IIA is a success because of the dedication and hard work of countless individuals who share a common goal: to advance the index industry and serve the best interests of investors around the world.

It has been an honor to serve as the IIA’s CEO and I look forward to watching the index industry continue to evolve. The journey is far from over – our work continues.

Rick Redding

CEO, Index Industry Association (2012-2024)

You might also be interested in

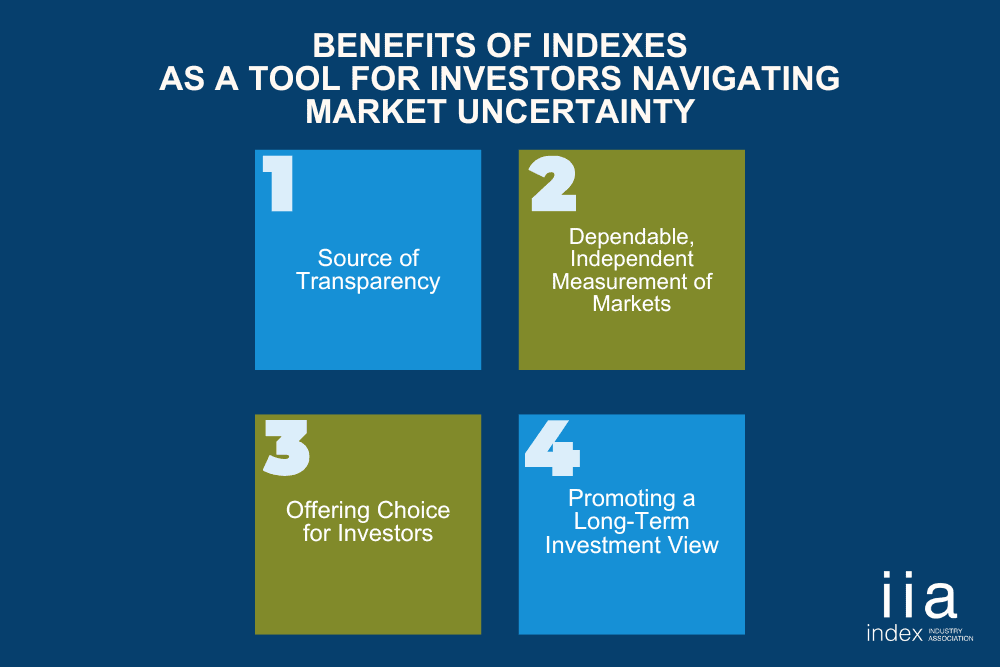

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…

Voices of the IIA – Varun Pawar, ICE

Articles, Member Insight May 28, 2024 The Index Industry Association sat down with Varun Pawar, ICE Fixed…