As part of our ‘Voices of IIA’ series, we sat down with Catherine Clay, Executive Vice President, Global Head of Data and Access Solutions at Cboe Global Markets

From floor trader to Executive Vice President, Cathy Clay’s 360° view of the exchange industry is helping Cboe Global Markets define the future. Cathy helms the newly created Data and Access Solutions division (DnA) that aims to simplify global market complexities through innovative data, analytics and index offerings.

What does Cboe’s approach to indexing tell us about the evolution of the index industry and your larger philosophy?

At Cboe, we innovate to define markets that may benefit all participants. Often, this begins with indexing, which long has been a Cboe core competency. In 1983, Cboe created the first index options contracts based on the home-grown OEX Index. In 2003, Cboe redefined how the markets view volatility with the Cboe Volatility Index (VIX). Today, Cboe’s pioneering of versatile strategy-based benchmark indices, such as the BXM Index, is again reshaping the industry landscape. While we remain committed to derivatives-based and traditional multi-asset indexing, we are excited to chart tomorrow’s course and empower a new generation of investors with solutions related to digital assets, ESG and beyond.

How has your involvement with the Index Industry Association Board of Directors changed or informed your approach?

The IIA serves as an important platform for promoting best practices that strengthen markets and serve the needs of investors. As a member, Cboe believes that by bringing together index providers, exchanges and other market participants in open dialogue, meaningful advancements in indexing can be accelerated. These advancements bring greater transparency and strength to the global markets that benefit all investors.

What do you see as the biggest challenges ahead for the index industry and how do you approach them?

Like most industries, the biggest challenge is finding what’s next. We know that index providers play a crucial role in evolving the market, and with the emergence of several new and exciting technologies, we again have the opportunity to address the needs of a changing investor class. To that end, Cboe regularly engages with a broad spectrum of customers and is relentless about bringing client-centric solutions to market. This process, which always begins with investor needs, often touches various points of the investment lifecycle, and we collaborate across Cboe from indices and data, to listings and trading, to help clients meet their goals.

For example, we knew back in 2015 that the next frontier was going to be target outcome investing. Cboe developed a suite of Target Outcome Indices that enable investors to pre-define risk-return objectives to achieve a pre-determined level of portfolio returns over a set time period. We took what had been complex and opaque strategies that were available only to sophisticated investors and democratized access to these powerful tools. These indices now serve as the basis for products that are increasingly helping wealth managers and retail investors reach their financial objectives.

In what areas do you see index providers providing leadership that is needed in the industry?

While there are a whole host of ways that index providers can lead the financial industry, three primarily spring to mind: innovation, advocacy and education. As I’ve highlighted, index industry innovation has been — and will continue to be — key to the evolution of financial markets. Today the marketplace is evolving in new and interesting ways, investors’ objectives are changing to encompass sustainability, ESG, digital assets and other ideas not pervasive five years ago. Index providers will help our customers measure new aspects of the marketplace and provide the basis for new products and services that assist market participants in achieving prosperity on their terms.

Index providers must advocate for fair and consistent regulation. As the assets tied to indices has increased, so too has the global desire to promote investor confidence in benchmarks. There are now global standards and a few jurisdictions have implemented regulations, while others have relied on industry best practices and customer due diligence to guard against bad actors. It is crucial that index providers, market participants and regulators agree on approaches that are objective aligned, correctly sized and innovation friendly. These types of approaches create a backdrop against which index provision can be trusted without stifling important advancements.

And lastly, as with everything else in the world, education is key for index providers. At Cboe, we believe that education is the foundation for healthy, vibrant markets. We engage with all stakeholders that interact with the markets — investors small and large, legislators and regulators across jurisdictions — to inform not only how the markets operate, but on the prudent use of the products and services we provide, including indexing. Cboe aims to operate a trusted, inclusive global marketplace, providing leading products, technology and data solutions that enable participants to define a sustainable financial future. We believe innovation, advocacy and education are critical to delivering on this mission.

You might also be interested in

Member Insight: “Redefining the Role of Index Providers” – S&P Dow Jones Indices

Index providers play a foundational role in the index-based products and asset allocation model portfolios now widely…

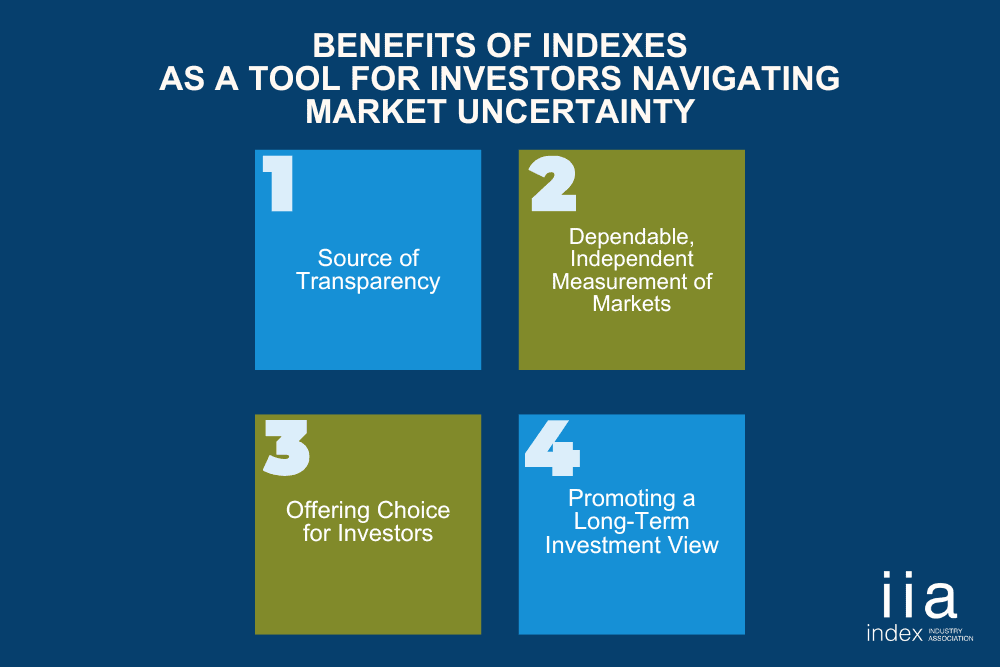

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…