As part of our ‘Voices of IIA’ series, we sat down with Sean Wasserman, Vice President and Global Head of Index & Advisor Solutions at Nasdaq. As an index provider as well as a trading and listing venue, Nasdaq sees the indexing industry from a variety of viewpoints. We discussed how Nasdaq sees its role in the larger industry and what insights can be gleaned from Nasdaq’s philosophy of indexing.

How does your current role at Nasdaq tell us about the evolution of the index industry and Nasdaq’s philosophy on indexes?

The index industry has come a long way since its beginning. Over time, the index industry has developed in coordination with significant market trends. So, too, has the ETF industry. ETF’s have actually driven a lot of the adoption of indexes that has taken place, as well as some of the changes in the ways indexes are being calculated or expressed. Indexes began to be looked at as a way to express a rules-based, transparent, systematic investment strategy, which index providers, such as Nasdaq, could offer. These index providers could follow up that offer by recommending to their clients coordinating investment products to track those indexes. Nasdaq’s overall philosophy in regard to indexes involves a commitment to providing expressions of the market that enable investors to access strategies that would benefit the investment goals they are trying to achieve.

How do you see Nasdaq’s role as an index provider informing its place in the larger financial ecosystem?

I see Nasdaq’s role in the larger financial ecosystem being focused on three key areas: The first is investor education. As an index provider, we aim to provide investors with an understanding of how indexes are designed, as well as an understanding of the investment objectives indexes can help a person to achieve. The second area we are focused on is investor need. At Nasdaq, we intentionally design our indexes as our markets evolve so they properly reflect different investment goals. The third area we are focused on is holistic support to our issuers, from ideation, research, visibility, listing to trading. Indexes are significantly incorporated into the ETF ecosystem, and Nasdaq (and the trading it offers) is a key part of it.

What do you see as the largest challenges ahead of the index industry and how do you approach them?

One of the biggest challenges is trying to figure out what investor needs have not yet been met, and then how we can develop indexes to help investors track them. There are still green-field spaces where we can provide value and innovate. For example, we have been focusing on certain thematic concepts that investors may not have access to, given the limitations that have existed historically with traditional sector classifications. Options-based indexes are in the relatively early days of design and adoption, but we see a lot of opportunities with them. There are also newer asset classes, like digital assets, where we have been looking to provide appropriate benchmarks.

In what areas do you see index providers providing leadership that is needed in the industry?

Index providers fill a much-needed educational role. Since indexes are the underpinnings for many of the investment products in the industry, it’s important for investors to understand how indexes are built, and what investment exposures they are providing. Nasdaq offers a very wide breadth of education and guidance regarding this information—how Nasdaq indexes are designed, what exposures they provide, and what the portfolio that people are investing in looks like. Index providers continue to be at the forefront of educating and helping people to understand what it is that is in their portfolio.

What facets about independent index providers should the financial industry know that may be overlooked?

One of the key things that is overlooked about independent index providers is the independence provided as part of the financial market’s ecosystem. There are very strong governance controls that independent index providers put in place to ensure the integrity of the methodology and index are properly implemented. Additionally, the controls are in place to ensure true expression of intent of that methodology, where the index provider is neither the investment manager, nor the sponsor of the investment product tracking the index.

You might also be interested in

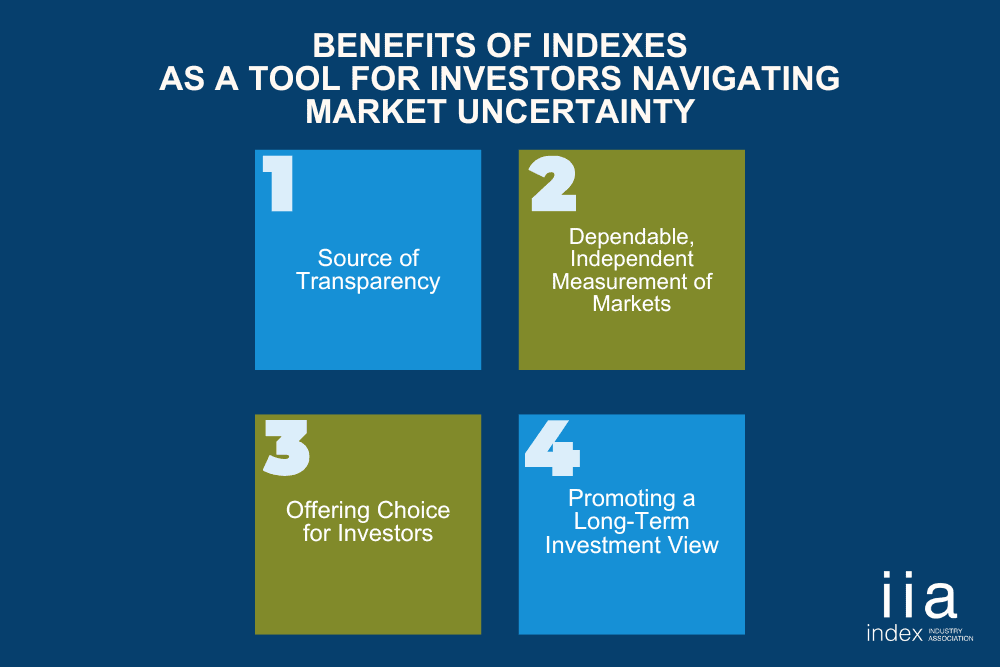

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…

The Future is Bright for the Index Industry

A Message from Retiring CEO Rick Redding It has been an incredible honor to lead the Index…