As he assumes the chair of the Index Industry Association, Dan Draper, CEO of S&P Dow Jones Indices, reflects on the evolution and impact of indexing on financial markets. He writes about the development of indices more than 100 years ago and the IIA’s role in strengthening and protecting the independence and integrity of these market benchmarks.

I am deeply honored to assume the chairmanship of the Index Industry Association this year. Since 2012, the IIA has been a tireless advocate for independent index providers globally. As the IIA celebrates its 10th anniversary this year, now more than ever, our role in educating people about how indexing has transformed and democratized access to financial markets is crucial.

Indeed, indexing has rapidly evolved over the past three decades, growing from a relatively niche and obscure segment of the global financial market into a mainstream part of investing, retirement saving and generational wealth-building.

Today, global index providers collectively offer roughly three million indices that track and measure the broader markets as well as more targeted market sectors and segments. This means that overall the indexing industry is ripe for competition and innovation.

Transparency has been a founding principle of the IIA, with its members committing to making index methodologies publicly available. Thanks to transparency and independent indices, there are more data and insights available today to help us better understand and evaluate market risks, returns and opportunities. Indices help investors make informed decisions to meet a wide range of financial goals.

Indices themselves have been around for a long time. Iconic gauges such as the Dow Jones Industrial Average (DJIA), the S&P 500 and many other benchmarks are not only tracking the market’s daily ups and downs but are also reflecting its most pivotal moments. For example, indices have borne witness to the changing fortunes of the corporate world, industry shifts in the global economy and the rise of new companies. Indices reflect the market’s history and longevity and provide an eye towards its future.

The value and benefits that indices and indexing have brought to global markets cannot be underestimated. While independent index providers do not manage money, trade or develop investment strategies, indices are licensed and utilized as building blocks for index-based financial products such as exchange-traded funds. The demand for indices and index-based products such as ETFs continues to grow driven by their transparency, efficiencies and low costs.

An S&P Dow Jones Indices’ study illustrated the strength of savings derived from indexing over the past 25 years. S&P DJI estimated that indexing has generated investors approximately USD 357 billion in cumulative savings in management fees. This study used three of S&P DJI’s core U.S. equity indices as a sample. If we consider the cumulative benefits derived from all the indices available linked to ETFs and other index-based investment products, the aggregate amount of savings would be far higher.

In addition to their lower costs, performance is another key driver of the growth of indexing and the shift to index-based or passive investing from active management. S&P DJI has been tracking the performance of actively managed funds versus their respective indices and has found that active managers, which typically charge higher management fees, are trailing their benchmarks in terms of performance. In one of its recent data from December 2021, S&P DJI found that more than 80% of U.S. large-cap funds underperformed the S&P 500 over a 10-year period. Indices and indexing with their cost benefits have contributed to increased market competition. Ultimately, healthy competition among index providers and a diversity of choice benefit end investors.

Indices and the indexing industry as a whole will continue to reflect the ongoing evolution of global financial markets. Since its founding a decade ago, the IIA has served as the unified voice for the indexing industry and remains committed to maintaining an open and constructive dialogue with a diverse group of market participants and stakeholders.

The IIA and its members recognize their important contributions to and role in the broader financial ecosystem and will continue to uphold the highest standards of integrity and transparency in our industry to promote sustainable global financial markets and foster healthy competition and innovation.

My goal as IIA chairman is to identify new ways to increase connectivity and engagement among existing and new members and encourage dialogue from diverse perspectives globally. I am proud of this opportunity to collaborate with my fellow indexing industry peers, who like S&P DJI, are pioneers in implementing best practices in index governance, accountability and benchmark quality.

As the IIA celebrates its 10th anniversary, our work continues.

You might also be interested in

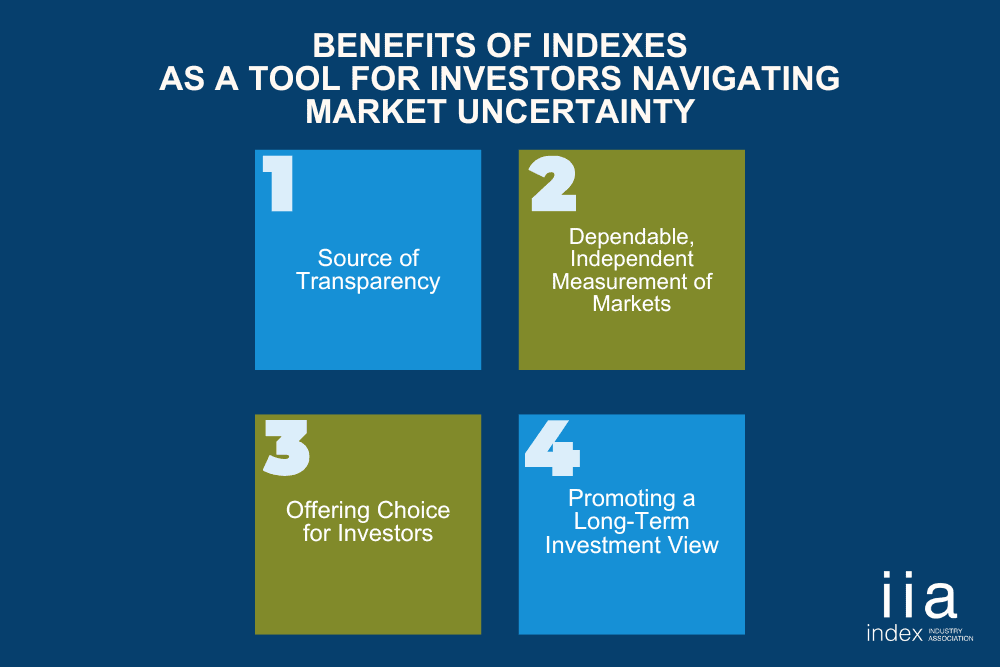

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…

The Future is Bright for the Index Industry

A Message from Retiring CEO Rick Redding It has been an incredible honor to lead the Index…