Voices of the IIA – Tom Kuh, Morningstar Indexes Head of ESG Strategy

The IIA sat down with Thomas Kuh, Head of ESG Strategy for Morningstar Indexes, to talk about his role at Morningstar, perspectives gathered from his more than 30 years in ESG indexes and market data and the current environment for sustainable investing.

Q: You have decades of experience in socially responsible investing and ESG but are new to Morningstar. Can you provide a bit on your background and your current role?

I joined Morningstar in 2022 as Head of ESG Strategy at Morningstar Indexes, which can be considered a relative startup within a much larger, established firm. I have three areas of focus. First is ensuring connectivity with other areas of Morningstar, including ESG leader Sustainalytics to help progress our ESG indexes strategy. Second is driving the development of our ESG index suite. And third is speaking with the media and our clients to share our point-of-view and perspective.

Q: You’ve been in this area of the industry for a long time – 30 years in fact – what attracted you to indexes?

Yes, I’ve been in this business a long time! After a brief career as an academic economist, I was very fortunate to join KLD Research & Analytics when it was a start-up in the early 1990s. KLD was one of the pioneers in this area and had launched the first ESG – then it was called SRI - index. It was originally called the Domini 400 Social Index, then became the KLD 400 Social Index, then the FTSE KLD 400 Social Index and, eventually, the MSCI KLD 400 Social Index. Amazingly, this index has endured for 33 years.

After a few years at KLD as an analyst, I had the opportunity to set up an index business there. I was attracted to indexes and enjoy them so much because they speak the language of finance. They provide objectivity and transparency to markets and provide data that elevates the conversation about ESG investing. I worked with an asset manager to bring the first ESG ETFs to market in the early 2000s. My role at KLD grew as the firm grew and I ended up moving into subsequent chapters of my career as KLD was acquired by Risk Metrics then MSCI. KLD’s progression reflects how some of the biggest index providers got serious about the ESG market in the 2000s and began to invest in ESG research.

Q: What are some of the key challenges – as well as opportunities – for index providers in ESG today?

While the ESG index market grew slowly in the early years, it is now firmly entrenched and a very important part of the ESG conversation. In terms of market opportunity, we’ve seen sustainable investing grab hold first with institutional investors and, increasingly, in the retail and wealth segments.

The index industry I have experienced has been incredibly dynamic and interesting. We sit at the intersection of active and passive investing and the growth of sustainable investing. Index providers help sustainable investors by providing benchmarks. They are also especially important because they help define the sustainability characteristics for ESG strategies.

We saw the industry take off in 2019-2021, very strong years of growth and inflow for ESG funds. Though sustainable funds underperformed in 2022, investors would have been better off in them over the previous 3-, 5- and 10-year periods. And we continue to face some challenges in 2023, due in part to market performance but also political headwinds.

Q: What differences do you see between ESG investors across continents as well as from institutional to retail channels?

Europe has really been the engine for ESG growth, particularly among institutional investors. More than 80% of the global assets in sustainable funds are in Europe and the UK.

So many ESG-related investment strategies are incubated in the institutional market but many of these strategies then bridge over to the wealth market and we’ve really seen retail investors show up in the last decade.

In Asia-Pacific, the ESG market is still relatively small but growing quickly. In North America, Canadian pension funds have been instrumental in driving ESG investment. There’s a lot of cooperation and communication among these funds. The US has hit a bit of a “speed bump” lately with the politicization of ESG, but up until 2022 and 2023 it was growing robustly.

Q: Speaking of “speed bump,” what is your take on the current ‘ESG backlash’ we’re seeing in the US?

Despite the growing debate in Washington around ESG, investors are still seeing ESG-related factors as material to their portfolios. In fact, the overwhelming majority of the largest global institutional investors we have reached out to over the last two years for our annual Morningstar Voice of the Asset Owner Survey believe ESG is material to their investment policy. And, while we have seen some clients pull back on their commitment to ESG in this environment, I believe the long-term trend toward more sustainability-driven investment approaches will continue. It will be interesting to see how the ESG debate evolves as we go into the upcoming US presidential election.

Q: How have the technical aspects of market data and indexes changed through the influence of technology and AI?

When I started, the Internet was not widely used. We sourced information from print media and databases to gather ESG information on companies. We were solving a scarcity problem as there wasn’t a wealth of ESG data available.

Eventually, information became more abundant and readily available to our clients, so they began asking us to interpret the data. What does the data tell us? what does it mean? So ESG research moved into an analytical role and ESG ratings began to evolve.

Now, technology is essential. AI is being used for data gathering and increasingly as a means for analysis. AI will also be instrumental for gathering information that is not reported by companies. Technology is creating new sources, such as geospatial data, that is contributing to an increasingly rich ESG data ecosystem.

You might also be interested in

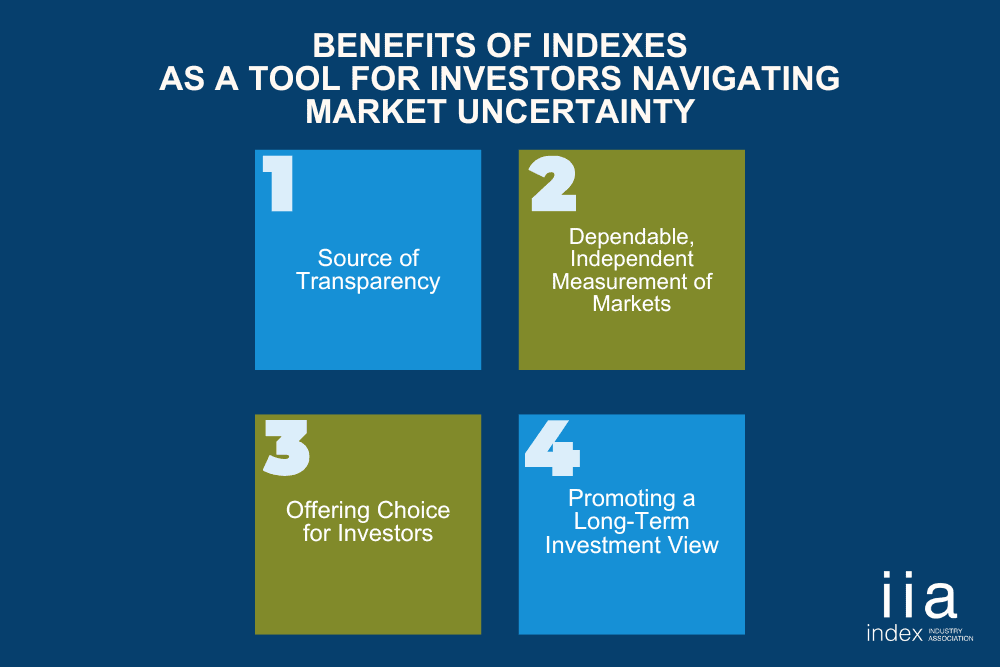

Market Uncertainty? Four Benefits of Indexes as a Tool for Investors

As investors navigate a bumpy sea of uncertainty amid geopolitical tensions, shifting tariffs, market dips and recession…

IIA CEO Unpacks Global Trends Shaping Investment Landscape

Perspective from Kirsten Wegner, IIA CEO In a recent webinar hosted by the ETF BILD Project, I…

The Future is Bright for the Index Industry

A Message from Retiring CEO Rick Redding It has been an incredible honor to lead the Index…